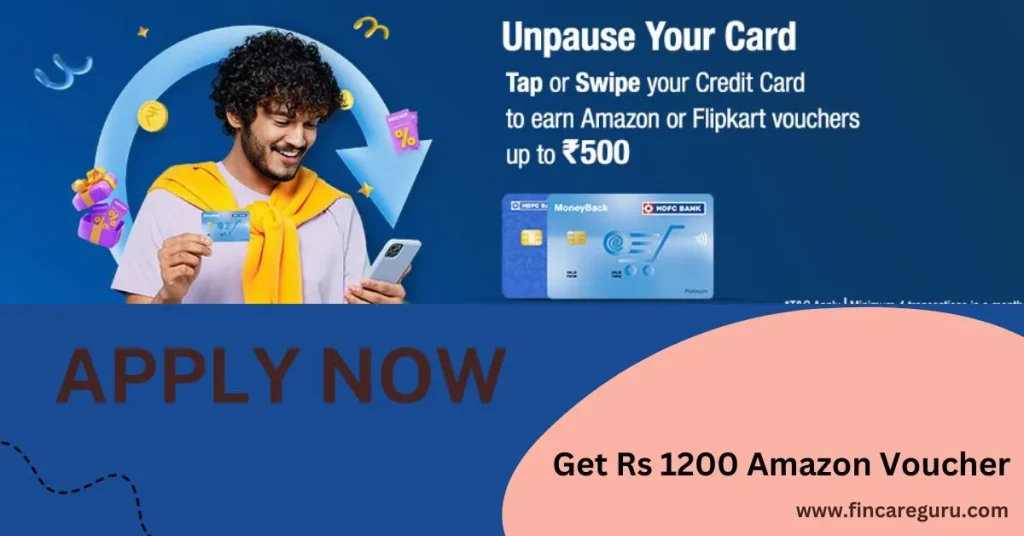

” For Rs 1200 Amazon Voucher-HDFC Bank” In today’s digital age, where online shopping has become an integral part of our lives, saving money while making purchases is a top priority for many. HDFC Bank, one of India’s leading financial institutions, understands this need and has come up with an exciting offer that’s sure to grab your attention – a chance to win a For Rs 1200 Amazon Voucher-HDFC Bank. In this article, we’ll delve into the details of this enticing promotion and how you can participate to reap the benefits.

Why Choose HDFC Bank Credit Card?

1. Financial Freedom

Credit cards from HDFC Bank provide unrivaled financial flexibility. You can use them to make both large and little purchases and pay for them whenever it’s convenient for you. You can efficiently control your costs if you have a credit limit that fits your financial situation.

2. Reward Points

The HDFC Bank credit cards’ large reward point system is one of its best qualities. Every purchase you make earns you reward points, which you can exchange for a range of goods including gift cards, electronics, and even plane tickets.

3. Security

Your security is a top priority for HDFC Bank. To prevent your transactions from fraudulent activity, their credit cards have EMV chips and PIN security.

4. Exclusive Offers

For the benefit of its credit cardholders, HDFC Bank frequently works in partnership with top e-commerce sites and businesses to offer exclusive deals. These deals can include everything from rebates on vacation reservations to discounts on purchases.

For Rs 1200 Amazon Voucher-HDFC Bank

Now, let’s dive into the main attraction – the Rs 1200 Amazon voucher offer. FINANCIAL BOSS frequently runs promotions for new credit card applicants, and the Amazon voucher is one of the most popular ones. Here’s how you can avail of this offer:

- Apply HDFC Credit card this Link. Rs 1200 Amazon Voucher

- Submit Application

- Sent Application No and Your Name (whatsapp No. 7311100258)

- Amazon Voucher Sent it After 7 days from credit card issuance date.

HDFC Bank Credit Cards Benefits

Credit cards are accepted as a cash alternative for all kinds of purchases, including booking hotels or flights, paying bills, getting the newest technology, and doing both online and in-person shopping. With your HDFC Bank credit card, you may quickly and simply pay for both expensive and low-cost things. Additionally, you can benefit from exclusive credit card discounts, deals, and points on both in-person and online transactions. With our partnerships with well-known companies like Amazon, BookMyShow, Swiggy, and Tata CliQ, among others, on a few cards, you can spend more while still saving more.

- LIFESTYLE : 5% Cashback on Amazon, Book my show, Zomato using the Millenia Card.

- TRAVEL: Complimentary lounge access across 1000 airports and extra reward points for flight bookings

- FUEL: 1% fuel surcharge waiver using Indian oil HDFC cards

- OTHER: Free gift vouchers up to Rs.2500.

Fees & charges

The annual and joining fees start from Rs. 500 and varies as per the card variant.

Related Articles : How 2 Get Personal Loan At Very Low Interest Rate

Documents Required

For Salaried employees:

- ID proof: Aadhar card, DL, Passport, PAN number

- Address Proof: Utility bill, Passport, ration card or any other government docs

- Income Proof: Salary Slip, employment letter.

For Self Employed:

- ID proof: Aadhar card, DL, Passport, PAN number

- Address Proof: Utility bill, Passport, ration card or any other government docs

- Income Proof: Certified financials, Recent ITR, Audited P&L or balance sheet etc.

Final Opinion

Applying for an HDFC Bank credit card is a lucrative move because it gives you access to a wealth of financial opportunities and compensates you with a Rs 1200 Amazon gift. So, if you’re looking for a credit card that offers ease and rewards, think about the HDFC Bank credit card and start taking advantage of the advantages right away.

How I will get my voucher from HDFC Credit Card?

Within 45 days of the first eligibility E-Mail and SMS date, eligible consumers must claim the voucher of their choosing. All gift certificates are good for a minimum of three months. On the gift voucher’s SMS or email, the precise expiration date will be stated.

Is IDFC First Bank credit card lifetime free?

Lifetime free on all IDFC First Bank credit cards. There are no joining or yearly fees for cardholders to pay.

Can we get HDFC Millennia credit card lifetime free?

The HDFC Bank does not grant free credit cards for life. But it offers its users credit cards with minimal fees and the chance to earn a fee refund when they reach certain spending milestones. These HDFC credit cards provide excellent savings and benefits on travel, eating, entertainment, and other purchases.

How to get 3 lakh credit card limit?

Increase your credit score: Since banks take credit score into account when determining credit card limits, it is preferable to have a high score. You can achieve this by promptly paying all of your obligations, including EMIs.

Is MoneyBack plus lifetime free?

No, the HDFC MoneyBack Plus Card is not lifetime free.

Sand me contact number