“How can you close your ICICI Bank Credit Card?” The largest private sector bank in India, ICICI Bank provides a variety of financial products and services to its customers. The ICICI Bank credit card, a plastic card that allows customers to credit money from the bank up to a set amount and use it for purchases or payments, is one of its well-liked products.

Things to Remember before closing the ICICI Credit Card

How can you close your ICICI Bank Credit Card?, there are a few things that cardholders should keep in mind:

- Make sure there are no outstanding balances on the credit card before closing it. This includes outstanding balances, interest, charges, and other expenses. Negative effects on the credit score may occur if all outstanding debts are not paid.

- It is recommended to use any reward points that the card has accumulated before it is closed. This is due to the fact that reward points are generally lost when a card is closed.

- If the credit card is used for making automatic payments for any bills or subscriptions, it is important to inform the vendors about the impending card closure. This will help prevent any missed payments or penalties.

- The cardholder may not be able to receive a refund upon card closure if they have already paid the yearly fee for the current year. It is recommended to call the bank in advance and inquire.

- It is advised to obtain a written confirmation of the credit card cancellation from the bank after cancelling the account. In the case of any future issues or problems, this will be used as proof of the closure.

How to Close ICICI Bank Credit Card?

2 Best ways “How can you close your ICICI Bank Credit Card?“

- Calling Customer care Number.

- Credit Card Cancellation Request online.

Calling Customer care Number

To close an ICICI Bank credit card, you can call the customer care service of ICICI Bank. Here’s how you can do it:

| How to Close/Cancel other Bank Credit card |

|---|

| How to close kotak 811 credit card online |

| How to close RBL Bank Credit Card Online 2023 |

| How to close SBI Bank account online? |

| How to close SBI credit card online |

ICICI Credit Card Cancel Request Toll-Free Number 1860-120-7777 / 1800-10-80

- You can call the customer care number of ICICI Bank.

- After connecting to the customer care executive, you will be required to authenticate yourself by providing your credit card details and personal information.

- Once you have been authenticated, you can request to close your credit card. The customer care executive will ask for a reason for closure and may try to convince you to keep the card open. You can explain your reasons for wanting to close the card.

- A reference number or proof of the closure will be given to you by the customer service representative along with a confirmation that the credit card has been closed. Please remember to write down this reference number for your records.

- Verify that any outstanding balances have been paid off on the credit card before closing it. The customer service representative can provide you with the card’s outstanding amount so you can, if needed, make a payment.

- Check your email or SMS for a closure confirmation after a few days. If you don’t receive a response, check up with the customer service representative again or personally go to a bank branch to make sure the card has been closed.

Credit Card Cancellation Request online

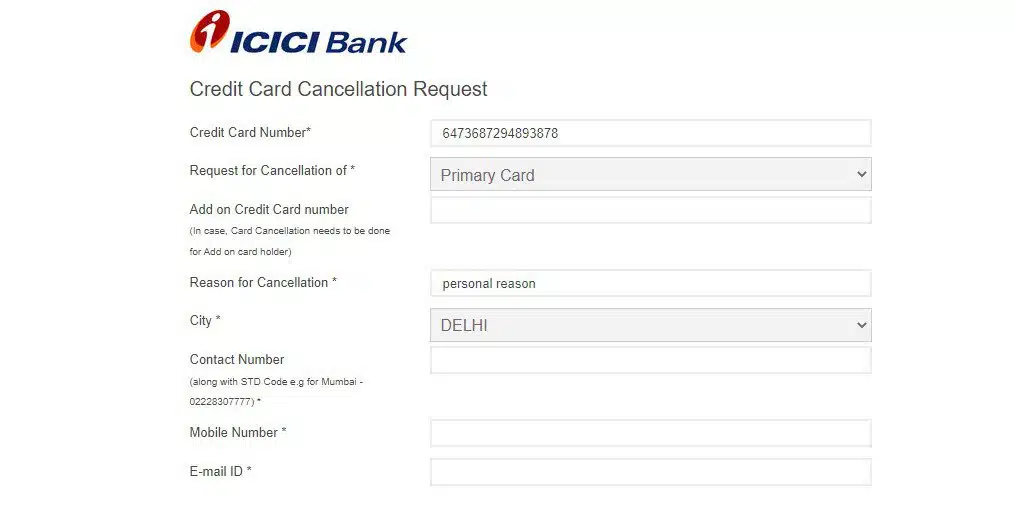

The credit card holder can submit the credit card cancellation form to close the credit card. The customer request from the official website of ICICI Bank. Simply fill it in with your details. You need to provide details like Credit card number, Reason for cancellation, City, Mobile Number, Email.

Once the cancellation request has been submitted, an ICICI Bank representative will call you. This procedure demands time (upto 3 days). Confirm the cancellation request and provide him with the details. Your credit card will be cancelled seven days after the confirmation. And you stop making purchases or paying with the credit card.

Conclusion

“How can you close your ICICI Bank Credit Card” In conclusion, you must settle any outstanding balance and use any reward points before you may cancel your ICICI Bank Credit Card. You can then submit a letter to the branch where you opened the credit card account or call ICICI Bank customer service to seek closure. To prevent any misuse, be sure to cut the credit card into pieces after it has been closed. It’s crucial to be aware that you could have to pay a small fee and that it might take a few days to close your ICICI Bank credit card.

[WPSM_AC id=3876]