Visit a branch to find out how to close ICICI Bank account step-by-step. In-depth instructions are provided in this comprehensive guide, along with responses to frequently asked questions about account cancellation. Learn how to complete the process without experiencing any difficulties.

The decision to close a bank account is a big one, and the best way to do it if you’re an ICICI Bank customer is to go to a branch. This article will guide you through the procedure, giving you step-by-step directions and insightful advice to ensure a smooth account closure.

We’ve got you covered, from acquiring the appropriate paperwork to resolving any potential issues. Let’s go into the specifics of closing your ICICI Bank account physically by going to a bank.

How to Close ICICI Bank Account Online

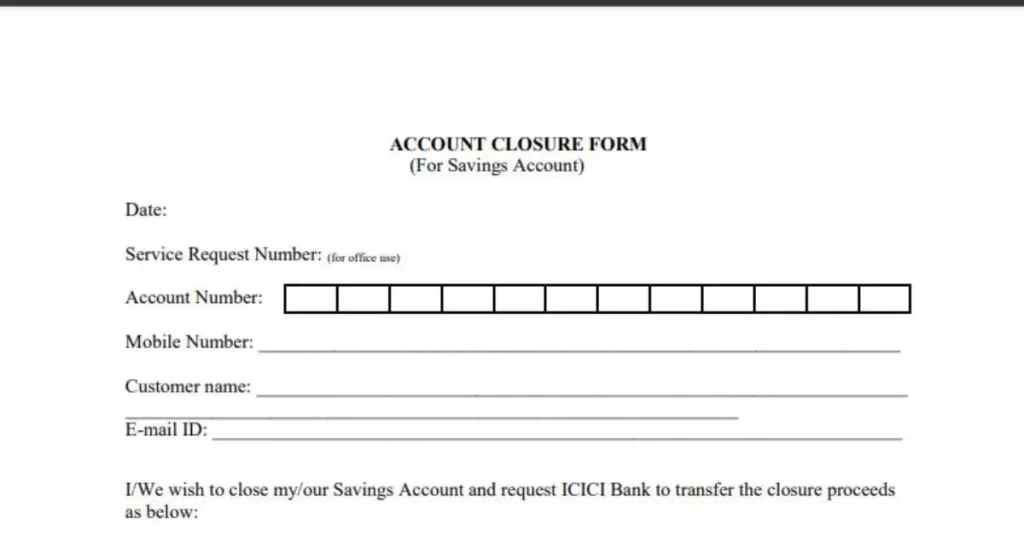

It is not possible to close an ICICI bank account online, but a form for doing so can be downloaded from the official website.

| Article | ICICI Bank Account Closure Form |

|---|---|

| Bank | ICICI Bank |

| Language | English |

| Form PDF Download | Download Here |

Related Article .. How to close Kotak Bank Account

How to Close ICICI Bank Account: Visit Branch

By going to a branch, you can easily close your ICICI Bank account. You may make sure that the closing process goes smoothly by following to the guidelines listed below.

- Initiate the Closure Process: In order to close your account, you should first tell the bank. The best way to do this is to speak with a representative at any ICICI Bank branch.

- Collect the Required Documents: Collect the required paperwork before visiting the branch. These normally consist of your debit card, account passbook, and any unused checks or demand drafts. Bring a passport-sized photo along with proof of your address and a valid form of identification.

- Schedule an Appointment: Make an appointment with the branch ahead of time to save time and assure fast service. You can have a focused meeting with a bank representative in this manner without having to wait in long queues.

- Be Prepared for the Visit: Be sure to be on time and prepare properly the day of your appointment. To prevent any delays or issues throughout the process, bring all the necessary documents listed in Step 2.

- Meet with the Bank Representative: You will be guided through the account closing process during your visit by a bank representative. In addition to giving you the necessary paperwork to fill out, they could investigate you about why you decided to close the account.

- Address Outstanding Dues or Liabilities: Before closing the account, make sure that all outstanding debts, such as unpaid fees, charges, or loans, are settled. The bank representative will provide you the precise amount owed and instruct you on how to make the payment.

- Request a Closure Acknowledgment: Requesting a closure acknowledgment from the bank is important. This document confirms that you have started the process of closing the account. Keep a copy on hand for reference and possible questions later.

- Confirm Deactivation of Account Services: Verify with the bank representative that all services connected to your account, such as internet banking, mobile banking, and SMS alerts, have been disabled after you have finished the proper procedures and paid any outstanding debts.

- What to Do with Your Remaining Balance? Choose what you wish to do with the account’s remaining balance. It can be moved to another account, withdrawn in cash, or turned into a demand draft. The bank person will walk you through your alternatives after hearing about your preferences.

- Update Financial Information and Standing Instructions: Make sure to transfer any standing instructions that were connected to your ICICI Bank account, such as SIPs (Systematic Investment Plans) or utility bill payments, to your new account or to make the appropriate updates.

- Transfer Standing Instructions to Another Account: Inform the bank representative of your new account information and any standing instructions you desire to continue. They will help you easily transfer the standing instructions.

- Inform the Bank about Closure: Additional Steps: It’s best to notify the bank in writing that your account will be closed. Include pertinent information like your account number and contact details in a formal letter or email that you send outlining your intention to shut the account.

- How Long Does the Closure Process Take? The duration of the closure procedure may vary based on a number of variables, including unpaid balances, account activity, and the effectiveness of the branch. The closing typically takes between 7 and 10 business days to complete.

How to Write an Application Letter for Account Closing

ICICI Bank Branch Address City, State, ZIP Dear Sir/Madam, I am writing to request the closure of my ICICI Bank account. Kindly assist me in initiating the account closure process as soon as possible. Account Details: Account Holder Name: [Your Name] Account Number: [Your Account Number] Please let me know the required steps and documentation for the closure process. I have settled all outstanding dues and liabilities associated with the account. Thank you for your prompt attention to this matter. Yours sincerely, Your Name Your Address City, State, ZIP Email Address Phone Number Date

ICICI Bank Account Closure Charges

The account holder may close their ICICI Bank account for any causes. Therefore, the account user must carefully consider his options before closing his ICICI bank account.

| Type of Account | Charges |

|---|---|

| ICICI Savings Account | No Charges for closing within 30 days of account opening Rs. 500 for closure during 31 days to one year No charges after one year of account opening |

| ICICI Current Account | Within 14 days – Nil After14 days to 6 months – Rs 1000 After 6 months – Rs 500 |

| ICICI Demat account | NIL |

Final Opinion

The process of closing your ICICI Bank account in person at a branch is simple and guarantees a problem-free termination. You can easily complete the closure process by adhering to the instructions listed in this guidance.

It will be easier to complete the closure procedure if you’ve informed the bank, gathered the required paperwork, and scheduled an appointment. Addressing any unpaid dues or liabilities and obtaining a closure acknowledgment are necessary actions to carry out during your visit to the branch.

Important factors to take into account throughout the closure process include confirming the deactivation of account services, determining what to do with the leftover amount, and updating your financial information and standing instructions. A thorough account closure will also be ensured by providing the bank with written notice and following up on any extra instructions or requirements.

To get answers and peace of mind, don’t forget to express any specific queries or worries you may have during your branch visit. Your account should be closed within a fair amount of time, which is normally 7 to 10 working days.

You can successfully terminate your ICICI Bank account and continue with your financial plans by adhering to these instructions and taking an active approach. Please get in touch with ICICI Bank’s customer support if you have any additional questions.

By closing your ICICI Bank account, you put an end to one financial chapter and make room for other possibilities. We appreciate you choosing ICICI Bank as your banking partner and hope your future ventures are successful.

FAQs

How can I close my ICICI Bank account?

Simply go to the nearest branch and advise the bank employee that you want to close the account to close your ICICI Bank account. They will aid you in finishing the closure process by walking you through each stage and guiding you through it.

Can I close my bank account online?

The online closure option is not available to close an ICICI Bank account. To start the account closure procedure, you must visit to a branch.

How to close ICICI Bank account without visiting branch?

You must visit to a branch in order to close an ICICI Bank account. Sadly, there is no other way to close the account besides going to a branch. To ensure a seamless and proper closure of your account, it is crucial to go through the regular closure process by visiting the local ICICI Bank branch.

Can we close a ICICI bank account from another branch?

Yes, it is possible to close an ICICI Bank account from a branch other than the one where the account was initially opened. To start the account closing process, go to any ICICI Bank location that is convenient for you. Simply advise the bank agent at the branch of your decision to terminate the account, supply the relevant information, and take the necessary actions to finish the closure procedure.

What is minimum balance in ICICI bank?

Account holders must maintain a minimum average monthly balance of Rs 10,000 for metro or metropolitan areas, Rs 5,000 for semi-urban locations, and Rs 2,000 for rural areas for the ICICI Bank regular savings account.