It is very easy to open a bank account online, we can open any bank account in the branch or even sitting at home. But when it comes to closing the account then it is a bit difficult. And if we talk about online close then it is more difficult. So today we will see how to close IDFC FIRST bank account online .

IDFC First Bank Account Close step by step follow

There are several reasons why someone may choose to close a bank account, including:

- Switching banks: You may wish to change banks if you’re unhappy with the fees or services offered by your present bank. Often, closing your old account is a step that is necessary in this procedure.

- Shifting: You might want to close your current bank account and create a new one nearby if you’re moving to a new city or country.

- Too many accounts: If you have multiple bank accounts and find it difficult to manage them, you may want to close one or more accounts to simplify your finances.

- Fees: If your bank charges high fees for services or you’re not happy with their fee structure, You might want to cancel your account and transfer your funds to a bank with better fees.

- Security: You might want to close the account to protect your funds if you suspect that your account has been compromised or that you have been the victim of fraud.

- Inactivity: If you have an account that you don’t use anymore, closing it can help you avoid maintenance fees or other charges.

Related Article.. How to close Bank of Baroda Bank Account

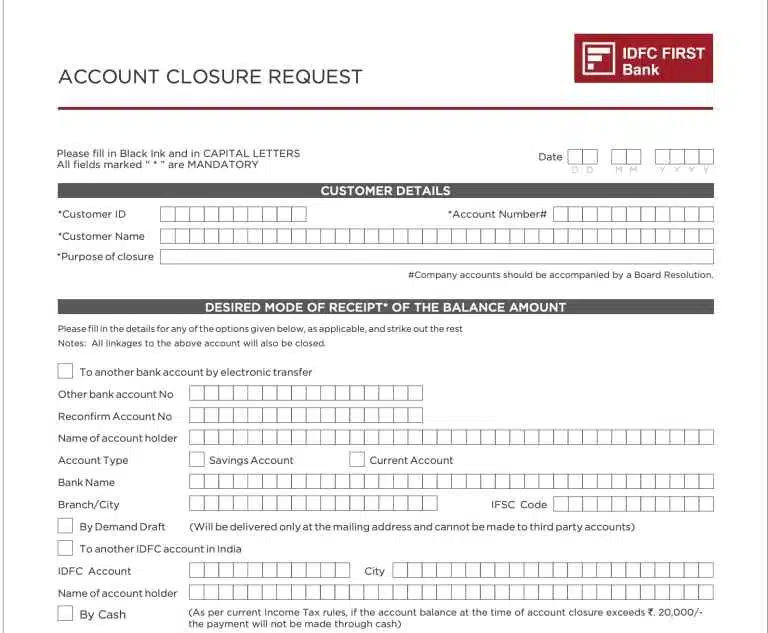

While it is possible to open an IDFC bank account online, it is not possible to close one. Downloading the IDFC bank account closure form is the sole action you can do to close an IDFC bank account online. Although closing a bank account is a simple procedure, all the processes must be carried out properly. When closing a bank account properly, be sure to fill out the account closure form completely, including providing your bank account number.

| Article | IDFC FIRST Bank Account Closure Form |

| Bank | IDFC Bank |

| Language | English |

| PDF Download | Download Now |

Important Points to keep in mind while closing an IDFC FIRST Bank Account

- Ensure that all outstanding dues and loans linked to the account are cleared before initiating the account closure process.

- Keep your original ID proof and address proof documents handy, as you will need to submit them to the bank representative for verification.

- Collect all necessary documents like account closure form, account closure confirmation, and any remaining balance in the account.

- In case of joint accounts, all account holders must sign the account closure form.

- It is advised to ask the bank if there are any closing-account fees that apply.

- Any account linked services like ATM cards, online banking, standing instructions, etc., should be canceled before initiating the account closure process.

- It is advisable to take a written acknowledgement from the bank for submitting the account closure form.

- Keep a record of all communication with the bank regarding the account closure process.

- Once the account is closed, ensure that all automatic transactions or direct debits linked to the account are canceled.

- If there are any problems or disputes during the account closing process, take them up with the bank’s grievance handling procedure.

How To Close IDFC First Bank Account Online?

- IDFC FIRST Download Closure Form: Getting the IDFC bank Account Closing Form is the first step in closing an IDFC bank account. To collect an account closure form, visit your local IDFC bank branch or download it from our page or the IDFC bank’s website.

- Fill up the IDFC FIRST Closure Form: Provide the right information for your bank account number in the account closing form. After filling out the form, verify all the information. Fill out the form completely, sign where it asks you to, and then give it to the branch manager or the executive in charge of the IDFC bank.

- Write Application Letter For Closing IDFC First Bank Account: To close a bank account, it is necessary to write an application on a white paper along with the account closure form, so that our account can be closed quickly.

- Carry your original ID proof and address proof documents: You will need to carry original ID proof and address proof documents like Aadhaar card, PAN card, Passport, Driving License, Voter ID, etc. These documents will be used to verify your identity and address.

- Attach your KYC Documents: All account holders are required to include a copy of their KYC documents, including a copy of their PAN and address verification, with the account closure form. It may also be necessary for account holders to self-attest these documents.

- Submit ATM, Cheque Leaves and Passbook: The account holder must return any ATM, check, or Passbook receipts to the bank. All ATM, cheques, and passbooks are surrendered after which your application for account closure is completed.

- Transfer or Withdraw Money: If the documents you’ve provided are accurate after being verified by the bank, you will be asked to take the remaining funds from your account. You can transfer the funds to another account, have the bank issue a check or DD in your name, or withdraw cash.

Application Letter For Closing IDFC First Bank Account

IDFC FIRST Bank [Branch Address] [City, State, Pincode] Subject: Request for Account Closure Dear Sir/Madam, I am writing this letter to request the closure of my IDFC FIRST Bank account number (Your Account Number). I have been a customer of your bank for (Duration of account usage), but due to my personal reason, I have decided to close my account. Please find enclosed my original ID proof and address proof documents for verification purposes. I request you to kindly provide me with the account closure form and any other documents that need to be completed for the account closure process. I would like to thank you for your services during my association with your bank and appreciate your support in the account closure process. Thanking you. Sincerely, Your Name Mobile No. Full Address

2nd ways Close IDFC First Bank account

Send the account closure form and other required documentation to the bank branch by courier in order to close your IDFC FIRST Bank account. You can do as follows:

- Download the account closure form from the IDFC FIRST Bank website.

- Fill up the form with accurate information and sign it.

- Make sure you have cleared all outstanding dues and loans linked to the account and there is no balance outstanding in the account as on the date of account closure.

- Enclose the filled-up account closure form along with Photo copy ID proof and address proof documents.

- Pack the documents in a courier envelope and ensure that it is securely sealed.

- Write “Account Closure Request” on the envelope.

- Visit your nearest courier service center and courier the envelope to the nearest IDFC FIRST Bank branch. You can check the branch address on the bank’s website.

- Once the bank receives your courier, they will initiate the account closure process.

- The bank may contact you for any additional information or documentation if required.

- After the account closure process is completed, the bank will courier the account closure confirmation and any remaining balance in the account to your registered address.

IDFC First Bank Account Closing Charges?

| Period | Charges |

|---|---|

| 0 to 14 days | Free |

| After 15 days to Before 1 Year | Rs. 200 to 800 (Depending on the types of saving accounts) |

| After 1 Year | Free |

Conclusion:

In conclusion, you must go to a nearby IDFC First Bank branch or get in touch with the customer service department if you want to close an account with the bank. You will need to complete an account closure form and provide all required documents, including your account number, ID proof, and proof of address.

The bank will process your request to close your account once they have verified your information and determined there are no unpaid amounts or fees. The process of cancelling the account might take a few days, and the bank might charge a fee for doing so. Before beginning the process of closing an account, it is always preferable to discuss the specifics with a bank representative.